Our Services

Comprehensive tax and accounting services tailored to your needs

Bookkeeping & Financial Services

Professional bookkeeping services to keep your finances organized and compliant with ATO standards.

- Monthly financial statements

- Bank reconciliation services

- Accounts payable/receivable

- GST/BAS preparation

- Cloud-based accounting setup

Business Accounting

Comprehensive accounting solutions for businesses of all sizes, from startups to established companies.

- Annual financial statements

- Management reporting

- Budget planning & forecasting

- Business structure advice

- Compliance management

Payroll Services

Efficient payroll processing and management services to ensure your employees are paid accurately and on time.

- Weekly/fortnightly payroll processing

- Superannuation management

- PAYG withholding

- Leave calculations

- Payroll tax compliance

Financial Consulting

Expert financial advice and consulting services to help you make informed business and personal financial decisions.

- Financial planning strategies

- Investment advice

- Business growth planning

- Cash flow management

- Risk assessment

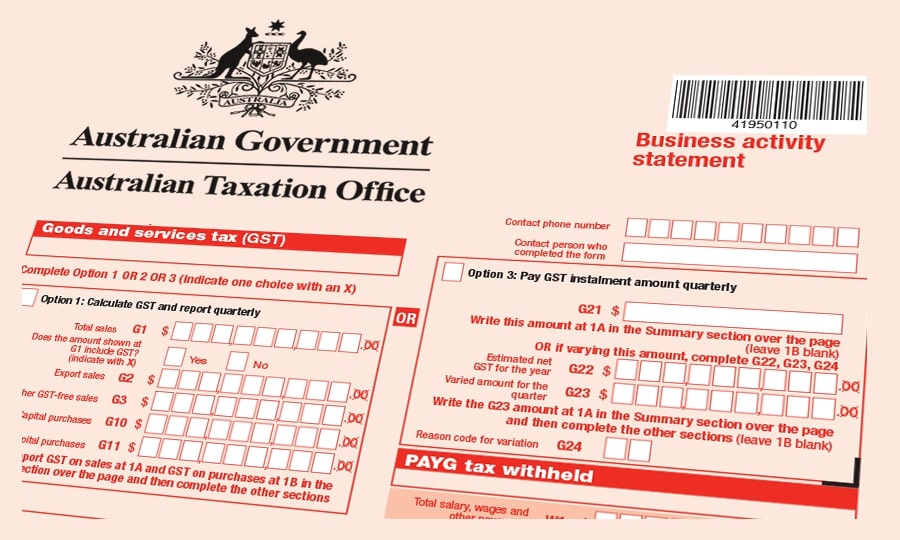

BAS & GST Services

Comprehensive Business Activity Statement (BAS) and Goods and Services Tax (GST) preparation and compliance services.

- Monthly/quarterly BAS preparation

- GST registration and compliance

- Input tax credit optimization

- GST reconciliation services

- ATO correspondence handling

Tax Planning & Advisory

Strategic tax planning and advisory services with transparent pricing and professional guidance.

- Individual tax returns

- Tax minimization strategies

- Capital gains planning

- Retirement planning advice

- Annual tax health checks

Company Tax Preparation

We prepare and lodge the company tax returns and help you lodge the TPAR (Taxable Payments Annual Report). We will send you notification when your tax return is due..

Rental Properties

Contact us today and see how we can help you in maximizing your rental expenses. We keep you updated with the rental and taxation reforms.

Accountant Letter and Advice

We can write a professional accountant letter for your business loan and needs. We can also provide you with the reference.

Special Discounts

We offer discounts based on various criteria for our registered customers

Students

Special discounts available for students

Low Income Individuals/Families

Support for low income individuals and families

Seniors

Senior citizen discounts on our services

Veteran & Financial Services

Special rates for Veteran and financial service clients

Our Reach Across Australia

Serving clients nationwide with expert tax and accounting services in major cities and regional areas

Sydney

New South Wales

Service :

In office or Online via Phone call or zoom meeting

Melbourne

Victoria

Service :

Online via Phone call or zoom meeting

Brisbane

Queensland

Service :

Online via Phone call or zoom meeting

Perth

Western Australia

Service :

Online via Phone call or zoom meeting

Adelaide

South Australia

Service :

Online via Phone call or zoom meeting

Canberra

Australian Capital Territory

Service :

Online via Phone call or zoom meeting

Nationwide Service Statistics

Major Cities Covered

Service Areas

Clients Served

Years Experience

Our Path to Maximum Returns Starts Here

My Personal Guarantee to You

-

Personalized Service: Every client receives individual attention and customized tax strategies tailored to their unique financial situation.

-

Maximum Returns: With 19+ years of experience, we ensure you receive every deduction and credit you're legally entitled to.

-

Full Compliance: Stay completely compliant with ATO regulations while optimizing your tax position for maximum benefit.

-

Ongoing Support: We're not just here for tax season - we provide year-round financial guidance and support.

"Building lasting relationships with our clients means going beyond just filing returns - it's about securing your financial future."

Schedule Your ConsultationRaman Singh

Director & Principal Tax Agent

Professional Credentials:

• Master in Accounting

• Member of Tax Practitioners

• 19+ Years Industry Experience

• Specialist in Business & Individual Tax

Tax Season Calendar & Resources

Stay ahead of important dates and access helpful tax resources

🗓️ July 1

New Financial Year Begins

Start organizing receipts and documents for the new tax year

📊 Oct 31

Individual Tax Returns Due

Deadline for individual tax returns (if lodging yourself)

⏰ May 15

Agent Lodgment Deadline

Extended deadline when using a registered tax agent

💼 Dec 31

Business Activity Statements

Quarterly BAS statements due for businesses

Essential Tax Resources

📋 Tax Checklist

Complete checklist of documents needed for your tax return

- Income statements

- Deduction receipts

- Bank statements

- Investment records

💰 Deduction Calculator

Estimate your potential deductions and tax savings

- Work expenses

- Vehicle costs

- Home office

- Investment deductions

📚 Tax Guides

Comprehensive guides for different tax situations

- First-time filers

- Small business owners

- Property investors

- Retirees

🔔 Tax Updates

Stay informed about the latest tax law changes

- Rate changes

- New deductions

- Policy updates

- ATO announcements

Why Choose Five Star Taxation Services?

Excellence, trust and results - based on over 9 years of experience

19+ Years Experience

Extensive experience in taxation and accounting services

Personalized Service

Tailored solutions for your unique tax situation

ATO Compliance

Fully compliant with all ATO regulations and requirements

Year-Round Support

Ongoing support and advice throughout the year

What Our Clients Say

"Excellent service! They helped maximize my tax return and made the whole process stress-free. Highly recommended!"

- Sarah Johnson"Professional and knowledgeable team. They saved me time and money with their expert advice."

- Michael Chen"Five Star Taxation has been handling my business accounts for years. Outstanding service every time!"

- Emma Wilson